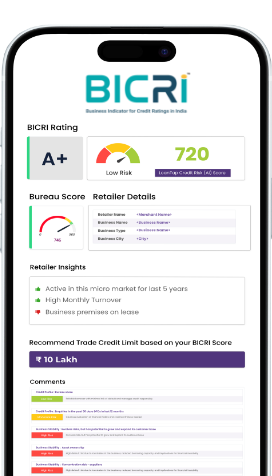

BICRI (Business Indicator for Credit Ratings in India) is your key to better financing options and stronger business relationships. It combines data from our proprietary AI scoring model and various credit bureaus and provides insights into your creditworthiness in the form of the BICRI score and a detailed report.

Why Choose BICRI Score?

Stay

credit-ready

By keeping yourself informed about your business’s credit health, you can work on problems and unlock new credit opportunities.

Identify

credit health problems

This report helps you identify problems with the credit health of your business, and also shares indications for improvement.

Increase

credit availability

This report can enhance your chances of securing credit more easily, giving you access to better financial opportunities.

Make

Informed Decisions

With the help of a clear, data-driven understanding of your credit status, you can make well-informed financial decisions.

How to get a BICRI report

Fill up the required details

Provide the details required in the form

Make the payment

You can make the payment using desired payment options like UPI, Credit/debit card

Download your BICRI Report

Download your report now and unlock your personalized insights and gain a deeper understanding of your business

Common Questions and Answers

BICRI is a retailer rating platform that provides a detailed overview of your business’s credit health. It assesses your business based on various parameters and comes up with a rating and a detailed report.

BICRI can help you identify and address issues with your business’ credit health and improve your negotiating power with lenders. By keeping informed about your credit status, you can address potential problems and unlock new credit opportunities.

The BICRI report can prove useful for retailers who need financing on a regular basis, as it will help them stay ahead of challenges and work on any issues in their business’s credit health.

No, the BICRI report is an evaluation of a business’ credit health and gives insights depending on the information provided by the retailer, data from credit bureaus, and our proprietary AI scoring model. The final decision on eligibility is made by the lenders.

BICRI’s comprehensive report provides a detailed analysis of your rating. It includes the AI score, which reflects your financial behavior. It also contains your Equifax score, the AI-predicted loan amount and the credit limit you're eligible to receive. This information offers a holistic view of your creditworthiness and borrowing potential.

Yes, once you sign up and provide the necessary details, you can access your BICRI score and detailed report at any time through the ‘My Account’ page.

If you spot any errors, please contact our team immediately. We will assist you in addressing and correcting any issues to ensure the accuracy of your report.

The BICRI report is valid for 3 months from the date of report generation and can be accessed at any time.

Your data is processed securely and is treated as confidential to ensure complete privacy and protection. We prioritize the safety of your information throughout all stages of data handling.