When it comes to growing your business, whether it’s launching a new project, expanding operations, or managing your daily expenses, securing the right funding is essential. One of the most common ways to do this is through a business loan. However, the actual cost of borrowing isn’t just about the loan amount but also the associated interest rate.

Business loan interest rates can significantly impact your financial planning, determining how much you’ll repay over the loan’s duration. A lower interest rate can help you save substantially, easing the burden on your business’ finances.

Here, we will look at business loan interest rates, how they are calculated, and how you can secure lower rates.

What is Meant by Business Loan Interest Rate?

A business loan interest rate refers to the percentage a lender charges on the total loan amount. This rate is the cost of borrowing, where the borrower pays an additional amount on top of the principal loan amount.

The interest rate is mainly based on factors like the loan type, the amount borrowed, the repayment period, and the purpose of the loan. This interest rate helps lenders compensate for the risk associated with lending funds to businesses.

What is the Interest Rate for Business Loans?

Below are LoanTap’s interest rate and other details for business loans:

| Particulars | Details |

| Loan Amount | Min – 50,000, Max – 10 lakhs |

| Tenure | Min – 6 Months, Max – 36 Months |

| Age | Min-23, Max-58 (Co-applicant required if age >55) |

| Rate of Interest | 19.99% to 26% p.a |

| Processing Fee | 2% to 2.99% + GST |

| Business Vintage | Min. 2 Years |

| Bureau Score | >=700, NTC allowed (with Loan amount capping) |

How to Calculate Interest for Business Loan?

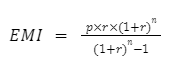

When applying for a business loan, it is important to consider the interest rate as it affects the total interest amount that is paid over the loan tenure and the total EMI.

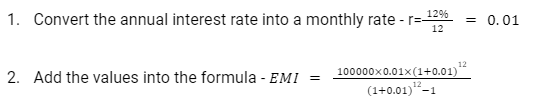

To calculate the payable interest amount for business loans, you can use the following formula:

Where,

P – the principal loan amount

R – the monthly interest rate (annual interest rate divided by 12)

N – the loan tenure in months

For example, let’s say you take a business loan of ₹1,00,000 at an interest rate of 12% per annum for 12 months. Here’s how you can calculate the EMI:

After solving the above equation, the EMI will be around ₹8,885 per month, with a total interest payment of ₹6,619. The total repayment for the loan would be approximately ₹1,06,619.

However, calculating the interest manually can seem complex. To ease this, you can use online EMI calculators provided by lenders, which will allow you to simply enter the loan amount, interest rate, and tenure.

This will help you get accurate results and plan your finances effectively.

Factors Affecting Business Loan Interest Rates

Depending on the lenders and borrowers, several factors can influence business loan interest rates. Understanding these factors can help businesses secure loans at favorable rates. Below are some of the factors that impact business loan interest rates:

1. Nature of the business

The sector in which your business operates helps determine the interest rate. Lenders usually classify loans based on whether the business falls under priority or non-priority sectors.

Priority sectors, which contribute substantially to the economy but struggle to access finances, may often receive loans at lower interest rates. Meanwhile, businesses in non-priority sectors may face higher rates as they have easier access to credit.

2. Business longevity

Lenders consider a business’s stability and sustainability before determining interest rates. A business with a longer track record demonstrates resilience and consistency, which might lead to a lower interest rate. Lenders usually prefer companies that have been operating for a minimum of six months, as a more established business is considered to be lower risk.

3. Business turnover

Lenders assess a business’s profitability and cash flow before lending it funds. A business with consistent profitability and a good turnover is more likely to secure a lower interest rate. Given the increased risk of defaulting, businesses with fluctuating or negative earnings may be offered higher interest rates.

4. Credit score

The credit score is one of the most important factors affecting loan interest rates. A credit score of 700 and above is generally preferred as it reduces the lender’s perceived risk of default. Businesses with higher credit scores are more likely to receive favorable interest rates, while lower scores may lead to higher costs.

5. Loan amount and tenure

The size and duration of the loan also influence the interest rates. Larger loan amounts and longer repayment tenures increase the lender’s uncertainty, which may lead to higher interest rates.

6. Market conditions

Economic factors such as inflation, demand for credit, and broader market trends affect interest rates. During economic stability and low inflation, interest rates may be lower. However, during economic downturns or periods of high inflation, lenders may raise interest rates to mitigate risk.

How to Secure Business Loans at Low Interest Rates?

Here’s how you can avail business loans at low interest rates:

1. Maintain a high credit score

Lenders generally prefer lending funds to applicants with a credit score above 700, which indicates a good creditworthiness. To improve your score, ensure timely payments of bills and EMIs and avoid defaults.

2. Opt for shorter loan tenure

A shorter repayment period reduces the lender’s risk, which can help borrowers secure lower interest rates. It also helps in minimizing the overall borrowing cost.

3. Provide collateral

Secured loans require you to pledge assets, such as property or equipment, and they often have lower interest rates due to a lower risk for the lender.

4. Borrow from reputed financial institutions

Established, experienced, and RBI-registered lenders usually offer competitive interest rates and better terms, ensuring you get a reliable deal.

5. Ensure consistent income

Lenders usually prefer applicants with a stable income source and a clear financial plan that proves your business’s ability to repay the loan.

6. Avoid defaulting on payments

A consistent repayment history builds trust with lenders and can help secure loans at favorable interest rates in the future.

Conclusion

Securing a business loan at a competitive interest rate helps maintain a healthy cash flow and reduces the overall cost of borrowing. Business owners can effectively lower their interest rates by maintaining a high credit score, opting for shorter tenures, and providing collateral. Additionally, choosing the right lender plays a significant role in ensuring favorable terms.

LoanTap, an RBI-registered NBFC offers flexible business loans to suit your unique needs. With competitive interest rates, easy application processes, and customizable repayment options, LoanTap ensures that you can focus on growing your business by leaving behind excessive borrowing costs. LoanTap’s business loans provide a reliable solution for your financial needs.

Frequently Asked Questions

What is the difference between a fixed and floating interest rate?

A fixed interest rate remains the same across the loan tenure, offering predictability. However, a floating interest rate can fluctuate based on market conditions, which could either increase or decrease your borrowing cost over time.

Can I negotiate the interest rate on a business loan?

Yes, it is possible to negotiate the interest rate with the lender, especially if you have a high credit score, strong business finances, or provide collateral.

What is the difference between APR and interest rate?

APR includes both the interest rate and other associated fees like processing charges, providing a more comprehensive view of the total borrowing cost. The interest rate refers only to the cost of borrowing money.

Does a business loan’s purpose affect the interest rate?

Yes, the purpose of the loan, such as purchasing equipment, working capital, or expansion, can influence the interest rate. Loans for specific purposes, like equipment loans, may have specialized, lower interest rates.

What are the interest rates for small business loans in India?

Business loan interest rates in India usually start from 12%, depending on the lender, loan type, and borrower’s creditworthiness.