While exploring the available loan options, you are most likely to come across two common interest types, flat interest rate and reducing interest rate. These terms might seem technical, but understanding the difference between them can help you choose a loan that truly aligns with your financial requirements and situation.

At first, both types of interest might appear similar; after all, the whole idea is borrowing money and paying it back with said interest. However, the way interest is calculated varies significantly, and that difference can have a big impact on your total repayment amount and even your monthly budget.

The main difference between a flat vs reducing interest rate is that a flat rate gives you a predictable monthly payment, as the interest is calculated on the entire principal amount at the beginning of the loan’s duration. Whereas, a reducing interest rate works on a dynamic structure, where interest is calculated on the outstanding balance after each payment. This means your interest costs decrease over time, potentially saving you money in the long run.

So, which option is better for you? Let’s look at the difference between flat and reducing interest rates to help you understand which one best fits your needs.

What is Flat Interest Rate?

A flat rate is a type of interest rate that remains constant throughout the duration of the loan. This interest rate is calculated on the entire principal amount from the start of the loan period. This means that regardless of the repayments made over time, the interest amount remains the same throughout the life of the loan.

When a borrower secures a loan with a flat interest rate, a repayment schedule is created, which includes the equated monthly installments (EMIs) that the borrower must pay. Since the interest rate is based on the total loan amount, this structure provides predictability in the repayment process, allowing borrowers to manage their finances accordingly.

Benefits of Flat Interest Rate

Opting for a flat interest rate on personal loans has several benefits, making it an appealing choice for borrowers. These include:

1. Simplified EMI Calculation

One of the primary benefits of a flat interest rate is the simplicity it provides in calculating EMIs. With a fixed interest rate applied to the full principal amount throughout the loan tenure, borrowers can easily assess their monthly payments. This simple calculation can help make the repayment process more manageable.

2. Predictable Financial Planning

A flat interest rate helps with better financial planning. Since the EMIs remain constant, borrowers can plan for their monthly financial obligations accurately. This predictability allows individuals to budget effectively, ensuring they do not exceed their repayment capacity. Knowing exactly how much to allocate each month helps in maintaining a stable financial situation.

3. Benefits of Prepayment

Another advantage of a flat interest rate is the opportunity for borrowers to reduce their EMIs through prepayments. If you decide to prepay a portion of your principal, the new EMI will reflect this change starting from the next payment cycle. As the flat interest is based on the principal amount, any reduction in the principal will subsequently lower your monthly payments, offering relief to your budget.

4. Clarity and Transparency

Flat interest rate calculations are generally easier to understand, which can be particularly beneficial for those new to borrowing. This method minimizes confusion about how interest is applied, making it accessible for all types of borrowers.

What is Reducing Rate of Interest?

The reducing rate of interest is a method of calculating interest on a loan based on the remaining principal balance. As you make your monthly EMI payments, a part of your payment goes toward reducing the principal amount. Since the interest is calculated on this decreased amount, your interest payments become lower over time.

Benefits of Reducing Rate of Interest

Below are some of the benefits of reducing rate of interest:

1. Decreasing Interest Amount Over Time

With a reducing rate of interest, the interest calculation is based on the remaining principal balance rather than the original loan amount. As the loan principal decreases with each EMI, the interest payable also reduces over time. This gradual decrease helps lower the financial burden, making the loan more affordable in the long term.

2. Lower Cost of Loan

A reducing interest rate can lead to substantial savings. Unlike flat interest rate loans, where the interest is calculated on the entire loan amount, the reducing balance method considers only the outstanding balance, resulting in lower total interest costs. This ultimately makes the loan more cost-effective, as you only pay interest on the unpaid principal.

3. Potential for Shorter Loan Tenure

Since the monthly payment may reduce over time with each installment, borrowers could potentially pay off the loan faster. This benefit is especially appealing for those who wish to clear debts early and minimize the time they’re tied to loan obligations.

Difference Between Flat and Reducing Interest Rate

When opting for a loan, it is important to choose the right interest rate for you as it directly impacts the overall repayment cost. The two primary interest rate types, flat interest rate and reducing interest rate, differ significantly in how the interest amount is calculated , influencing EMIs and loan tenure. Here’s a breakdown to help you understand the difference between flat and reducing interest rates.

1. Interest Rate Calculation Method

The major difference between flat and reducing interest rates lies in the way the interest is calculated.

Flat Interest Rate: The interest is calculated on the total loan amount (principal) at the start of the loan term. This means that the interest rate remains fixed throughout the loan tenure, and does not decrease even as you repay parts of the principal.

Reducing Interest Rate: The interest is calculated only on the outstanding principal balance. As you make payments, the principal reduces each month, which reduces the interest amount and, consequently, the EMIs over time.

Calculating EMIs varies for each interest rate type:

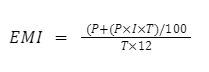

Flat Interest Rate Formula:

Where:

P = Principal amount

I = Interest rate

T = Loan tenure in years

This formula is simpler since it only requires the principal loan amount, resulting in a straightforward EMI calculation.

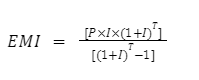

Reducing Interest Rate Formula:

This formula is slightly more complex, as it accounts for the outstanding principal balance, recalculating the interest on the remaining amount each month.

2. Repayment Flexibility

Flat Interest Rate Loans: Borrowers may benefit from a stable EMI amount throughout the loan term but may not be able to enjoy lowered costs over the loan tenure.

Reducing Interest Rate Loans: These provide more flexibility. Because interest decreases as the outstanding principal reduces, these loans may be more cost-effective, especially over an extended repayment period.

3. EMI Payments

Flat Interest Rate: The EMI amount remains constant throughout the loan term. This predictability can be beneficial for those who prefer a fixed monthly payment without fluctuation.

Reducing Interest Rate: The EMI amount decreases over time. Since interest is calculated only on the remaining principal, borrowers can see a gradual decline in their EMIs, which can ease the repayment burden over time.

Which is Better Flat or Reducing Interest Rate?

Choosing between flat vs reducing interest rates depends on your budget and repayment preferences. If you prefer predictability and fixed monthly payments, a flat interest rate may suit you better. However, if you’re looking for a potentially more economical option with, a reducing interest rate might be beneficial.

Conclusion

When it comes to choosing between a flat rate vs reducing rate, understanding your financial priorities is key. A flat interest rate offers predictability with fixed EMIs, which can be ideal for short-term loans or those seeking stable payments. On the other hand, a reducing interest rate is often more economical in the long run, as it calculates interest on the decreasing principal amount, resulting in lower EMIs over time.

LoanTap offers personal loans at competitive interest rates. With LoanTap, you can enjoy minimal documentation, quick approvals, and a repayment structure that works for your financial situation.

Frequently Asked Questions

Which type of interest rate results in lower overall costs?

Usually, a reducing interest rate results in lower overall costs, as interest is calculated only on the outstanding loan balance. With a flat interest rate, interest is calculated on the full principal amount.

How does EMI differ between flat and reducing interest rates?

With a flat interest rate, the EMI amount remains the same throughout the loan tenure. In contrast, with a reducing interest rate, the EMI decreases over time as the outstanding principal reduces, making it easier to manage for long-term borrowers.

How can I decide which is better flat or reducing interest rate type for me?

To choose between flat and reducing interest rate, consider your loan tenure, repayment capacity, and budget flexibility. If you prefer stable monthly payments, a flat rate may be better. If you want to save on interest and can handle changing EMIs, a reducing rate may be more advantageous.

Is a reducing interest rate the same as a floating interest rate?

No, a reducing interest rate differs from a floating (or variable) interest rate. A reducing rate calculates interest on the outstanding principal each month, whereas a floating rate fluctuates with market conditions or central bank rates, impacting your EMI based on economic factors.

Which interest type is better for personal loans: flat or reducing?

Personal loans usually have flat interest rates, and borrowers may prefer the fixed EMI structure. However, if the lender offers a reducing interest rate, you may be able to save more on interest.