Personal loans can be the most useful financial solution for anyone who needs extra funds for a big purchase, a family event, or an unexpected emergency.

But let’s say that you’re planning a wedding and find a great loan offer, only to discover later that your interest payment is higher than you expected. So, how do you make sure that you’re not paying more than you need to?

The above scenario is all too common, and interest rates significantly influence the cost of the loan. This tells us just how important it is to understand personal loan interest rates before you decide to take a loan.

Read on to learn more about the personal loan interest rates in India.

What is Personal Loan Interest Rate?

A personal loan interest rate is the cost of borrowing money and is usually denoted as an annual percentage. When you take a loan, you’re charged interest on the amount borrowed, and when you save or invest money, you earn interest. Interest rates are influenced by factors such as central bank policies, credit demand, and economic conditions. These fluctuations significantly impact consumer spending, investment choices, and broader economic activity.

Interest Rate on Personal Loan

The interest rate on personal loans is one of the most important factors that determines the total cost of borrowing. It directly affects monthly payments and the overall affordability of the loan. Here we have provided the personal loan interest rates and other fees charged by LoanTap:

| Fees | Applicable Charges |

| Rate of Interest | Up to 26% |

| Processing Fees | 2%-3% + GST |

| Bounce Charges | ₹550 |

| Pre-Payment Charges | 4% + GST if foreclosed within 180 days from the date of disbursement post-cooling off period |

| Platform Charge | ₹750 + GST |

| Broken Period Interest / Pre – EMI Interest | Depends on date of disbursement |

How to Calculate Interest for Personal Loan?

Calculating the payable interest amount on a personal loan is essential for understanding the total cost of borrowing and effectively planning your finances.

The easiest way to calculate the interest amount for personal loans is through an online EMI calculator.

Here, all you need to do is add in your loan amount, the interest rate and the repayment tenure that you have chosen. The EMI calculator will automatically calculate your monthly loan EMI and the total interest payable.

The other way is to calculate the interest amount for personal loans manually. For this, you can use the following formula:

Total Interest = Total Amount – Principal

Let’s use this formula in an example to understand it better.

Suppose Mr. Raj takes a personal loan of Rs. 4 Lakh at an interest rate of 14% per annum to be paid back in 2 years.

To solve this, let’s break down the information given:

Loan Amount (Principal, P) = Rs. 4,00,000

Annual Interest Rate (r) = 14% or 0.14

Loan Tenure (n): 2 years or 24 months

To calculate the monthly EMI, we’ll first convert the annual interest rate to a monthly rate and the tenure to months:

Monthly Interest Rate (r) = Annual Rate / 12

0.14/12 ≈0.01167

Tenure in Months (N) = 2 years × 12 = 24 months

- EMI Calculation

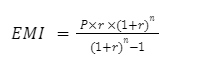

Using the EMI formula:

2. Total Amount Payable

The total amount payable is simply:

Total Amount = EMI X n

3. Total Interest Payable

The total interest payable can be calculated by subtracting the principal from the total amount:

Total Interest = Total Amount – P

Now, let’s calculate these values.

Here are the calculated values for Mr. Raj’s loan:

- Monthly EMI: Rs. 19,205.15

- Total Interest Payable: Rs. 60,923.68

- Total Amount Payable: Rs. 4,60,923.68

Factors Affecting Personal Loan Interest Rates

When applying for a personal loan, understanding the factors that influence your interest rate can help you secure better terms. Here are some factors that lenders consider when determining your loan’s interest rate:

Monthly Income

Your monthly income is one of the most important factors affecting both the amount you can borrow and the interest rate you receive. A higher income reduces the lender’s risk, as it indicates your ability to repay the loan consistently. Lenders are more inclined to offer lower interest rates to borrowers with stable and substantial income, as they see these individuals as less likely to default on their repayments.

Credit Score

Your credit score reflects your creditworthiness and financial responsibility. A high credit score indicates that you manage your finances well, making you a more attractive borrower. Generally, borrowers with a credit score above 700 may be eligible for lower interest rates, whereas those with lower scores may face higher rates due to the perceived risk.

Loan Repayment History

Your previous loan repayment history is reviewed, along with your overall credit score. Lenders check whether you have a track record of making timely payments. A consistent history of on-time EMI payments suggests that you are a responsible borrower, which can result in more favorable interest rates for your personal loan.

Moreover, a history of loan defaults can impact your ability to secure a personal loan. If you have a history of loan defaults, the lender may either deny your application or impose significantly higher interest rates to mitigate the risk associated with lending to you.

Debt-to-Income Ratio

The debt-to-income ratio (DTI) is an important statistic that tells the lender what portion of the borrower’s income goes towards their monthly debt payments. A DTI of 30% or less is considered favorable by lenders and may result in lower personal loan interest rates.

Tips to Avail Personal Loans at Low Interest Rates

Securing a personal loan at a low interest rate involves a combination of good financial habits and strategic planning. Below are a few tips to secure personal loans at low interest rates:

1. Maintain a Strong Credit Score

A good credit score is important to secure a personal loan. You must maintain a credit score of 700 and above to increase your chances of securing a personal loan with favorable terms. To maintain a good score:

- Pay bills on time: You must ensure that all your dues and debts, including credit card payments, are settled on time each month.

- Manage Credit Utilization: Keep your credit utilization ratio below 30%. This indicates that you’re not overly reliant on credit.

- Limit New Credit Applications: Avoid applying for multiple credit cards or loans in a short period, as this can negatively impact your score.

- Monitor Co-signed Loans: Ensure timely payments on any co-signed loans, as defaults can affect both your credit score and that of the primary borrower.

- Pay Off Credit Cards in Full: Avoid interest charges by paying your full credit card balance each month, which demonstrates responsible credit habits.

2. Shop Around for the Best Rates

Don’t settle for the first lender you find. You must conduct thorough research to find competitive interest rates:

- Compare Offers: Compare loan amounts, charges and more, of various lenders.

- Negotiate with Existing Lenders: If you have a positive history with your current bank or NBFC, inquire about their personal loan offerings, as they may provide lower rates to loyal customers.

3. Assess Your Employment History

Your employment stability also helps in determining the interest rate on your personal loan. Here’s what you need to consider:

- Job Stability: Lenders prefer applicants with at least two years of employment history, including one year with the current employer.

- Fixed Obligation to Income Ratio (FOIR): A lower FOIR indicates that your monthly obligations are manageable relative to your income, making you a less risky borrower.

- Employment Type: Being employed in a reputable organization, especially in government or PSUs, can enhance your application. Lenders view these positions as more stable, which may lead to lower interest rates.

Conclusion

Understanding personal loan interest rates in India is essential for making informed financial decisions. By being aware of the factors that influence these rates and exploring options from different lenders, you can secure a personal loan interest rate that best suits your financial situation. Whether you’re borrowing for personal goals or emergency expenses, being aware of the full cost of a loan can help you avoid unnecessary financial strain.

If you’re looking for a competitive personal loan, LoanTap offers a range of loan products with attractive interest rates and minimal documentation requirements. With quick processing times and flexible repayment options, LoanTap makes borrowing simple and affordable, ensuring you can access funds when you need them most.

Frequently Asked Questions

What factors influence personal loan interest rates in India?

A person’s credit score, income, repayment history, and the lender’s policies are some of the variables that affect personal loan interest rates.

How can I improve my chances of getting a lower interest rate?

You may increase your chances of getting lower personal loan interest rates by maintaining a high credit score, comparing rates from several lenders, and demonstrating a steady source of income.

Is the interest rate fixed or variable in personal loans?

Depending on the loan type and the terms provided by the lender, personal loan interest rates in India can be either fixed or variable.

Do prepayments or early repayments affect the interest rate?

No, prepayments or early repayments do not affect the interest rate directly; however, they can reduce the total interest paid over the duration of the loan.

How does my credit score impact the interest rate I receive?

Since a higher credit score indicates less credit risk to the lender, personal loan interest rates are often lower.