Holiday Loan

Plan your Dream Vacation with Holiday Loan up to ₹10 lakh

Get a Travel Loan from LoanTap at competitive interest rates, and enjoy a hassle-free loan application process with disbursal in 24 hours*.

Bharat Fintech Summit ‘24

Happy Customers

Loan amount disbursed

App Installs

Vacations are like a jigsaw puzzle, which includes pieces like travel, accommodation, food and drinks, and more. When you plan a vacation, you rework how every piece will fit to form a final picture. Our holiday loan is that one piece of the puzzle that finally completes the picture. Here’s how you can make the most of your vacation by using our travel loan.

We believe that everyone deserves to turn their dream vacation into reality. With our personal travel loan, you can make those dreams come true without the hassle. Here’s why our travel loan stands out.

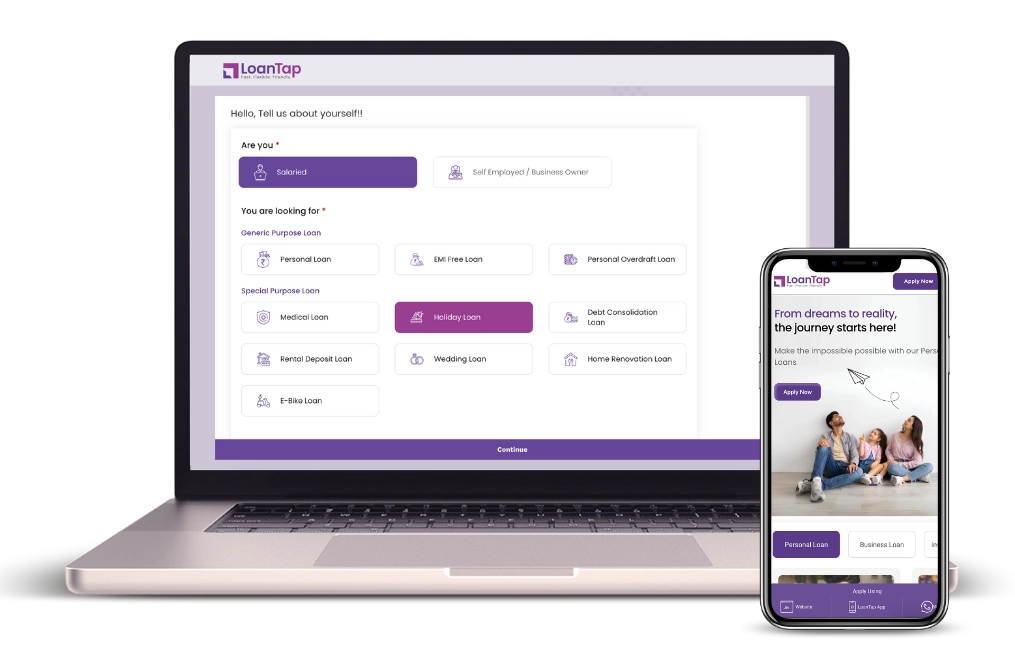

You can apply for a personal travel loan online through our website or mobile app.

Start the application by filling your basic information, employment and income details.

Upload the required documents and complete the KYC process.

Submit your application, and our team will review it. Once approved, you will receive the funds directly into your bank account.

We continuously strive to provide a

Seamless experience to our customers…

You can calculate your monthly loan payment (EMI) in just 3 easy steps! Drag the sliders to adjust your loan amount, interest rate, and loan term. See how these factors impact your EMI and understand your loan affordability clearly.

Calculate your EMI

Breakup of Total payment

A travel loan is a type of personal loan that is specifically designed to cover travel-related expenses, such as transportation, accommodation, activities, visa and other last-minute costs.

Our holiday loan application process is quick and straightforward. Visit our website or app, fill out the application with your personal, income, and employment details, upload the required documents, complete KYC and you’re all set.

Once you submit your application, it typically takes 24 hours* for your travel loan to be approved and disbursed into your bank account.

Once you submit your application, it typically takes 24 hours* for your travel loan to be approved and disbursed into your bank account.

To qualify for a holiday loan with LoanTap, you must be over 23 years of age, have a minimum monthly income of ₹30,000 and a credit score over 700.

Before you apply for a holiday loan with us, assess the total cost of the trip, your repayment capacity, the interest rate, and the loan tenure. Also, ensure that you have all the required documents and meet the eligibility criteria.

Yes, our vacation loans are unsecured, meaning you do not need to provide any collateral to receive the funds, making it a safe borrowing option.

Yes, you can use our holiday loan to cover not only Visa expenses, but other travel-related costs as well.

You can use LoanTap’s Holiday Loan EMI Calculator to calculate EMIs. Simply drag the sliders to adjust the loan amount, interest rate, and loan term. This will help you get a clear understanding of your payments.

No, our holiday loans can be used for any travel-related expense without any restrictions, making them a great financial solution when planning a vacation.

Interest rates on travel loans in India vary by lender and are influenced by the individual’s credit profile and factors like credit score, credit history, job stability, income, etc. LoanTap offers travel loans at interest rates up to 26%.

You will be charged a nominal processing fee of 2-3% on the gross loan amount sanctioned, plus applicable taxes.

Yes, you have the flexibility to make part-prepayments or foreclose your loan free of charge if you do so after 6 months of loan disbursal. However, a nominal fee of 4% will be charged for part-prepayment or foreclosure within the first 6 months.