Medical Loan

Medical Loans in 24 Hours* for Urgent Medical Expenses

Cover all medical expenses with LoanTap’s medical emergency loan up to ₹10 lakh with minimal documentation requirement.

Bharat Fintech Summit ‘24

Happy Customers

Loan amount disbursed

App Installs

Our medical personal loans can prove useful in multiple situations where it’s important to get quick access to funds.

We understand that medical expenses can arise at any time, and in such instances, our loan for medical treatment can provide the much-needed convenience and support.

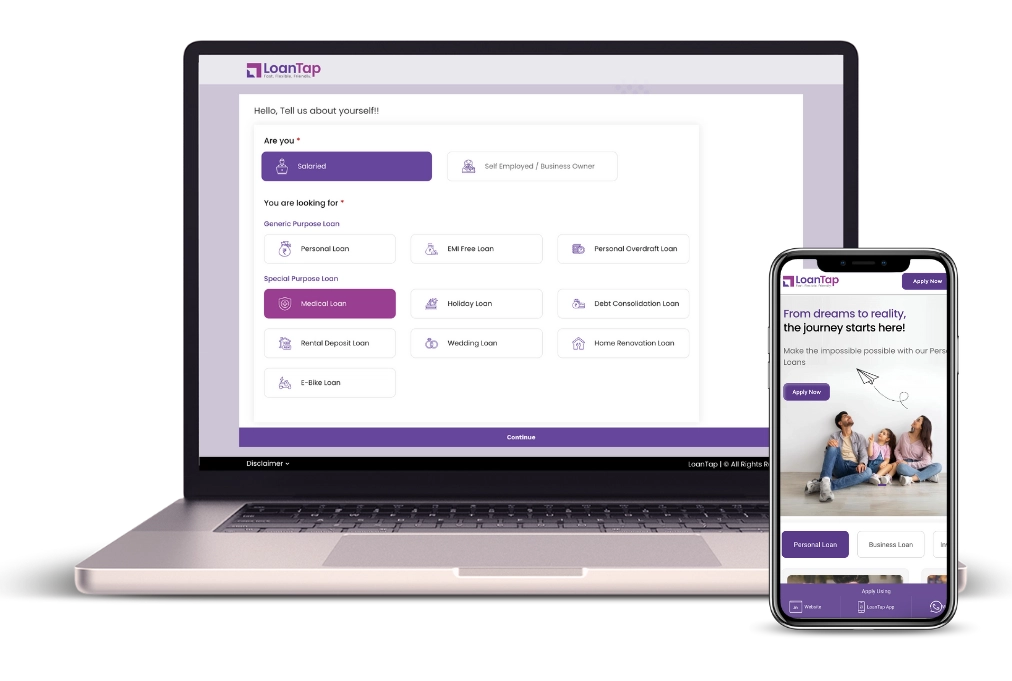

You can apply for a loan for medical treatment online through our website or mobile app.

Start the application by filling your basic information, employment and income details.

Upload the required documents and complete the KYC process.

Submit your application, and our team will review it. Once approved, you will receive the funds directly into your bank account.

We continuously strive to provide a

Seamless experience to our customers…

You can calculate your monthly loan payment (EMI) in just 3 easy steps! Drag the sliders to adjust your loan amount, interest rate, and loan term. See how these factors impact your EMI and understand your loan affordability clearly.

Calculate your EMI

Breakup of Total payment

To apply for a medical loan with LoanTap, you must be over 23 years of age, have a minimum monthly income of ₹30,000 and a credit score over 700.

No. LoanTap offers unsecured medical loans, which means you don’t need to provide any asset as collateral, making it a safe borrowing option.

LoanTap offers medical loans ranging from ₹50,000 to ₹10,00,000, providing you with the necessary funds for any medical expense. However, the final loan amount will depend on your eligibility and further bureau checks.

Our medical loans can be used for a variety of medical expenses, such as surgeries, consultation with specialists, medication, hospitalization, diagnostics, post-treatment care and more.

LoanTap provides medical loans at interest rates up to 26%. However, the interest rate you get will depend on your credit profile and factors like employment status, income, etc.

Absolutely. Our medical loan can not only be used for your own medical expenses but for your dependent’s or other family members’ expenses as well.

To apply for a loan for medical treatment, you must have a valid PAN card, Aadhaar card / Driving license / Passport, salary slips for the last 3 months and Bank statement for the last 6 months.

Understanding the urgency of medical emergencies, we approve and disburse our medical loans within 24 hours*.

Yes, you have the flexibility to make part-prepayments or foreclose your loan free of charge if you do so after 6 months of loan disbursal. However, a nominal fee of 4% will be charged for part-prepayment or foreclosure within the first 6 months.

To apply for medical loan online, visit LoanTap’s website or app, fill out the application, upload your documents and complete your KYC.

To apply for a medical loan with LoanTap, you must have a minimum credit score of 700.

We charge a nominal processing fee of 2-3% on the gross loan amount sanctioned, plus applicable taxes.