Calculate your EMI

Breakup of Total payment

Personal Loan EMI Calculator

Do you need money for a dream vacation, a sudden car repair, or even to consolidate debt? A personal loan can be a great solution, but amongst all of this, it’s easy to forget one important question: "Can I afford the monthly payments?"

This is where our Personal Loan EMI Calculator comes in! It's your one-stop solution to take the guesswork out of personal loan repayments.

All you need to do is enter your personal loan amount, interest rate, and tenure to see exactly what your EMI will be. This will give you a clear picture of how the loan will fit into your budget.

Benefits of LoanTap Personal Loan EMI Calculator

A personal loan EMI calculator offers several benefits that can make the loan application process smoother.

Enables Better Budgeting

Saves Time and Effort

Improves Accuracy

Customizable Parameters

Visual Representation

EMI Schedule

How to Calculate EMI for Personal Loan

With the LoanTap Personal Loan EMI Calculator, you only need to enter three essential details: the loan amount, interest rate, and loan tenure. This tool allows you to adjust these three parameters, changing the EMI amounts. For instance, increasing the tenure can lower the EMI amounts and vice versa.

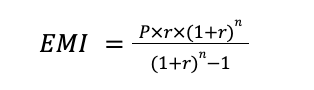

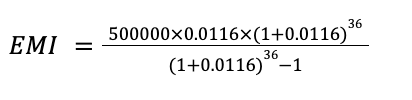

Formula to Calculate Personal Loan EMI

The formula for calculating personal loan EMI is:

Here,

P - loan amount or principal

r - rate of interest per month

n - number of installments or tenure of the loan in months

Here is an example to help you understand how exactly an EMI is calculated:

Let the loan amount be ₹5,00,000, the rate of interest be 14%, and the tenure be 3 years (or 36 months). Adding this to the formula, we get:

P= 5,00,000, r= 14/(12X100)= 0.0116, and n= 36

As per this formula, your monthly EMI will be ₹17,089.

Basic Eligibility Criteria For Instant Personal Loan

- Individuals with a minimum income of ₹30,000

- Indian citizens and residents who are at least 23 years old

- Individuals must have filed the latest ITR

Basic Documents Required for Online Personal Loan

- PAN Card

- Aadhaar Card/Driving License/Passport

- Bank Statement of the last 6 months

Frequently Asked Questions

You can choose a longer repayment tenure as this will spread the total repayment amount over a longer period and lower your monthly installment.

You must add the loan amount, interest rate, and tenure to the calculator. The calculator will then compute your monthly EMI based on these values.

The EMI for a 5 lakh personal loan for 5 years will vary as per the interest rate. For instance, if the interest rate is 14%, the monthly EMI would be ₹ 11,634.

Yes, knowing your EMI in advance can help you plan your monthly budget better and ensure you can afford the loan repayment.

A personal loan amortization schedule is a detailed table outlining each periodic loan payment over its entire term. It breaks down the payments into the principal amount and the interest portion, showing how much of each payment goes toward reducing the loan balance and how much is paid as interest to the lender.

Usually, the loan amount, interest rate, and tenure are the only factors the calculator considers when determining the EMI, and the processing fee is not considered.

Yes, unless interest rates change or you choose to make a prepayment, the EMI amount stays the same throughout the duration of the loan.

No, it's very easy to use. Once you enter the necessary information, it will calculate the EMI quickly and without any further effort required at your end.

Although this calculator is meant only for personal loans, you can use this for other kinds of loans by changing the parameters.