Marriage Loan

Create a Memorable Wedding Experience with Wedding Loans up to ₹10 lakh

Plan your special day with our wedding loan with 24-hour* disbursal and minimal documentation requirement. Apply today and make your dream wedding a reality!

Bharat Fintech Summit ‘24

Happy Customers

Loan amount disbursed

App Installs

Wedding planning involves a lot of costs that may vary based on preferences, number of guests, regional customs, etc. LoanTap’s marriage loan can be a great way to finance costs associated with your perfect wedding.

Wedding loans are a great way to make your special day even more perfect. Here’s why you should choose a marriage loan from LoanTap.

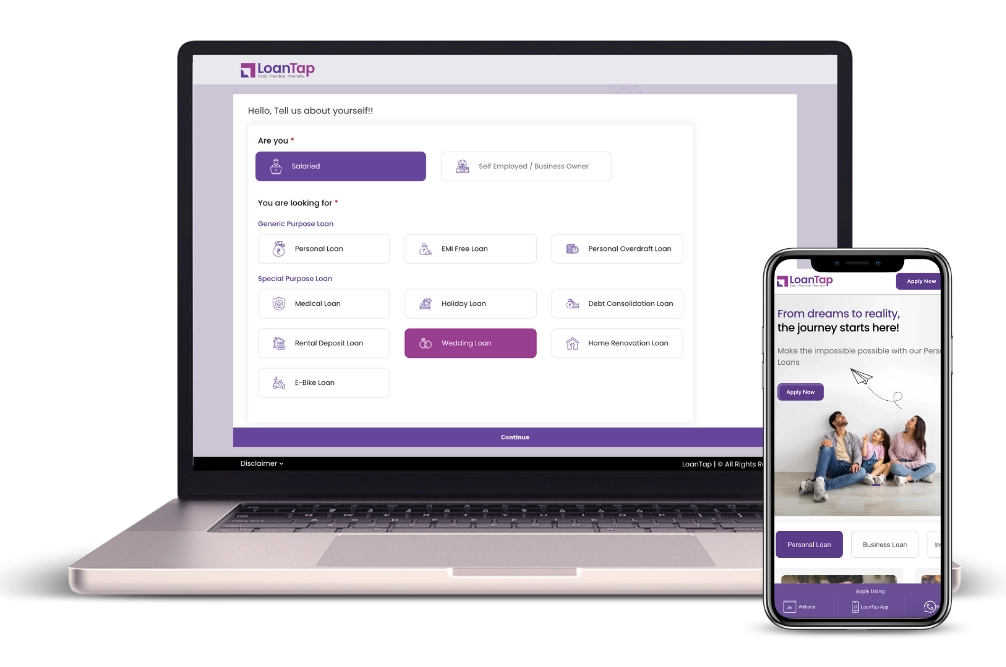

You can apply for a personal loan for weddings through our website or mobile app.

Start the application by filling your basic information, employment and income details.

Upload the required documents and complete the KYC process.

Submit your application, and our team will review it. Once approved, you will receive the funds directly into your bank account.

We continuously strive to provide a

Seamless experience to our customers…

You can calculate your monthly loan payment (EMI) in just 3 easy steps! Drag the sliders to adjust your loan amount, interest rate, and loan term. See how these factors impact your EMI and understand your loan affordability clearly.

Calculate your EMI

Breakup of Total payment

The processing fee for wedding loans with LoanTap is 2-3% of the gross loan amount sanctioned, plus GST.

Yes, you have the flexibility to make part-prepayments or foreclose your loan free of charge if you do so after 6 months of loan disbursal. However, a nominal fee of 4% will be charged for part-prepayment or foreclosure within the first 6 months.

The eligibility criteria for wedding loans may differ among lenders. To apply for marriage loan with LoanTap, you must be over 23 years of age, employed with a minimum monthly income of ₹30,000, and a credit score over 700.

Yes, you can log into your account on our website or app to check the status of your personal loan for marriage, repayment schedules, and other relevant information.

Yes, LoanTap is registered with the RBI and has a simple and secure marriage loan application process.

You can use our wedding loan EMI calculator to easily check your monthly payments based on the required loan amount, interest rate and preferred tenure. This amount will change as the three values change.

You can improve your chances of approval by maintaining a good credit score, providing accurate documentation, and demonstrating a steady income.

LoanTap offers wedding loans ranging between ₹50,000 and ₹10 lakh. However, the final loan amount may vary based on factors like your income, credit score, and debt-to-income ratio.

Interest rates on wedding loans vary by lender and are influenced by the individual’s credit profile and factors like employment status, income, etc. LoanTap offers wedding loans at interest rates up to 26%.

The application process for our marriage loan online is quick and straightforward. Fill out the application through our website or app with your personal, income, and employment details, upload the required documents, complete KYC and you’re all set.