With one generation paving way for the next, a new aspirational framework has started to evolve. More and more people are beginning to harbor dreams that are not constrained by the limitations of income, needs and resources.

In fact, the mindset which relies on cutting expenses and waiting for the monthly disbursal of salary does not seem to be relevant anymore. Instead, a new cohort of millennials has emerged whose primary purpose in life is to make the most of what they have today!

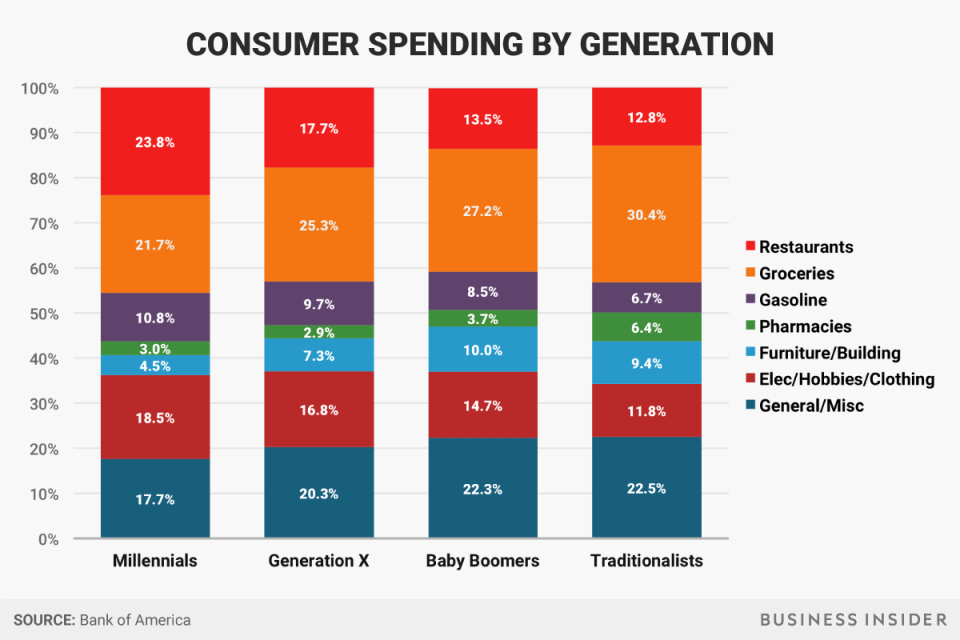

These changing lifestyle needs of the 7.4 billion global millennials have been highlighted in the chart below:

Image: Spending pattern by generations

In India, 34% of country’s population is millennials (approximately 440 million). Apart from essentials of home, followed by education and utilities, salary of millennial is spent on entertainment, eating out (32.7%), apparel & accessories (21.4%) and electronics (11.2%). This is quite a contrast to earlier generation who would not have spent on entertainment or eating out.

So, we now know that while older generations preferred saving up for miscellaneous or unforeseen expenditures, the millennials have taken an entirely different route. They are opting to spend money for fulfilling more instant requirements.

These changing lifestyle needs have then led to a complete transformation in the financial habits of millennials. It is precisely to cater to such reoriented demands that lenders – especially digital lending platforms – have started coming up with different varieties of loans that are pocket friendly, designed with manageable monthly cash outgo and can be availed quickly.

Millennials are now looking for easy-to-avail, collateral-free and pocket-friendly new age loans.

These special loans harbor the potential of providing millennials with the unique opportunity to give wings to their dreams without facing any hassle, struggle or stress.

Listed here are all loan products which have been specifically designed to fuel the aspirations of modern, Indian millennials –

- Holiday LoanHave you been planning to take a vacation but have been unable to do so because of the unavailability of finances? Don’t worry. A Holiday Loan will take care of all your travel expenses! Holiday Loans are flexible in nature and once sanctioned, you may use the amount to facilitate your journey within or outside the country. You will be able to take care of air fares, accommodation charges and other similar expenditures which are likely to be incurred during the trip.You can get Holiday Loan from LoanTap. You can instantly check your eligibility, apply through a simple online application form, upload few basic documents and after all required documents are submitted and verified you get disbursal within 24-36 working hours. Isn’t it great? More so, because, it allows you to make an interest-only payment for the first 3 months, so that you can have adequate time to recuperate from the high-expense holiday. These are flexible personal loans, and therefore, can prove to be the perfect fit for your vacation!

- WeddingGetting married is a once in a lifetime affair! So, why not make it count? Be it the royal palaces of Rajasthan or the tranquil shores of Goa, with a Wedding Loan, you can turn your marriage into a grand affair, not only for two of you but for everyone joining the ceremony. A Wedding Loan can help you bear marriage expenses without denting your savings. It also allows you to take financial matters into your own hands, instead of having your parents splurge their lifetime’s saving for one function!Quick Wedding Loan can be availed from LoanTap with flexible terms of payment. We have designed our loan in such a way that you pay interest only for first 5 months followed by EMI based loan. We understand your lifestyle post marriage and how high EMI payments can be overwhelming. The flexibility of Holiday Loans help you to ease your expenditure post-marriage. The EMI payment begins only from the 6th month onwards, thus, making your entire loan repayment process, stress free.

- Rental Deposit LoanMoving in to a rental apartment can often prove to be a difficult task. To begin with, you have to find an area that isn’t too far from your place of work. Then, you need to finalize an apartment that meets your specific requirements. This is followed by submitting a security deposit to your landlord, which is usually equivalent to a rental amount of 5-10 months! For a metropolitan city like Bangalore or Mumbai, where the rentals can be anywhere from Rs. 50,000 to 75,000 for 2 BHK in a good suburb, the deposit amount is sure to make a dent in saving. This cost is additional to shifting cost that you would bear.A Rental Deposit Loan from LoanTap can easily help you escape this grim situation. It allows you to directly deposit the security amount into the landlord’s account, without worrying about paying hefty EMIs. You are only liable to pay the interest amount, fort the duration of the lease. Once the lease terminates, landlord pays back the deposit amount. With a Rental Deposit Loan at your disposal, renting a home away from home becomes completely secure and uncomplicated.

- Advance Salary LoanAn expense does not always wait for your salary. It emerges out of the blue and can make a dent on your savings. Take for example – annual DTH TV recharge or an online shopping sale or an unexpected high electricity bill? Advance Salary Loan, in similar situations, is your best bet! This loan provides you with instant money that can be paid back within short tenure, unlike Regular Personal Loan.The Advance Salary Loan provided by LoanTap, for instance, permits you to borrow an amount up to 2.5 times your total salary. You can pay back this money in 3, 6, 9 or 12 months depending upon your capacity to bear the EMI within monthly salary. An Advance Salary Loan works wonders, especially when it comes to meeting instant demands. For millennials, it is a convenient way to tick items off their bucket list! . Click to Apply for Advance Salary Loan

- Premium Bike LoanHave you been holding off on that road trip because you didn’t have enough money? If that has been the case, don’t fret! A Premium Bike Loan will make sure that you get to own a bike of your choice within 24 to 36 hours. Premium Bike Loans with their attractive interest rates and flexible repayment periods can help millennials kick start their adventures, without having to wait any longer.These loans are available at LoanTap, with a 40% lesser monthly cash outflow and a 100% funding on the total road price. All you have to do is pay the interest amount due for the first 6 months, whereas the principal can be paid every 6 months. If you want to follow EMI structure of repayment, that option is available as well. The Superbikes are available at no down payment and payment is directly done to the distributor!

So, what are you waiting for? If you have been delaying your highly cherished road trip, the time to undertake it is now!. Apply for Premium Bike Loan

As a millennial, your dreams might not be always funded by your earnings. This is why all loan products at LoanTap, have been specially crafted to give you the ease of availing loans. You don’t just get to pay lower instalments, but you also get to enjoy great customer friendly terms and conditions too, like no prepayment charges or no part-payment charges to lower your monthly instalments.

With these demand-based loans sponsoring your goals, you wouldn’t have to worry about costs or savings anymore. The entire world would be yours to conquer!

Apply Today For an ⚡Instant Personal Loan with LoanTap. Download our Personal Loan App: Google Playstore / Apple App Store