Ever wondered why you pay interest on a loan or earn interest on your savings? It all comes down to interest rates. Interest rates affect everything, from mortgages and car loans to the financial activities of businesses and governments.

When you borrow money, you pay a fee for using it for a certain period. This fee is called the interest rate and is usually expressed as a yearly percentage. It is how banks and other financial institutions earn money by lending you money.

Keep reading to learn more about interest rates, their types, how they work, and the factors that affect them.

What is an Interest Rate?

An interest rate is a percentage charged or earned on the amount borrowed or lent for a specified time period. It is essentially the cost of borrowing money or the return on investment for savings.

There are two main types of interest rates:

- Fixed Interest Rate: This rate remains constant throughout the loan term or investment period.

- Variable Interest Rate: This rate can fluctuate based on market conditions or an index.

These rates are usually calculated annually and apply to both personal and business loans.

How do Interest Rates Work?

Interest rates determine the cost of borrowing money or the return on savings.

Let’s understand the two scenarios:

When you apply for a loan, you must repay the borrowed amount plus the interest. For example, if you borrow ₹1000 at an interest rate of 5%, you will need to pay ₹50 in interest each year.

When you deposit money in a savings account or invest, you earn interest on your balance. The interest rate determines how much you will earn over time. For example, if you deposit ₹1000 in a savings account at an interest rate of 2%, you will earn ₹20 in interest over a year.

Types of Interest Rate

Here are the different types of interest rates and how they affect the principal amount and the overall repayment:

Fixed Interest Rate:

A fixed interest rate remains constant throughout the loan period and must be repaid along with the principal amount every month. This is the most common type of interest rate charged on loans and provides stability and predictability for loan repayments. For instance, business loans and personal loans usually have fixed interest rates.

Floating or Variable Interest Rate:

Variable interest rates can change over time, depending on market conditions or the benchmarks set by the RBI. Your loan terms decide which benchmark affects your interest rate, leading to changing loan repayments. For example, car loans often have variable interest rates.

Simple Interest Rate:

A simple or regular interest rate is charged on the principal amount for a specific tenure. It is based on a simple calculation of how much money you owe. It does not consider other factors such as time, inflation, or repayment schedule. Calculating simple interest is easy using the formula – SI = P x R x T, where P is the principal amount, R is the Annual Interest Rate, and T is the Time period (in years).

Compound Interest Rate:

Compound Interest, also known as “interest on interest,” is a method where the interest earned is added to the principal amount, and future interest calculations are based on this new principal. Here, the interest is earned on both the initial principal and the accumulated interest from previous periods.

How to Calculate Interest Amount?

There are two types of interest rates – Simple Interest and Compound Interest. Let’s look at how to calculate interest using these two types –

Simple Interest:

The simple interest is a straightforward way of calculating interest earned or paid on the principal amount. This rate stays constant throughout the loan period and is calculated only on the initial principal amount. It is mostly used for short-term loans or investments where the interest does not compound over time.

Now, let’s look at how to calculate simple interest.

The simple interest formula is:

SI = P x R x T

Where,

P = Principal amount (the initial amount of money)

R = Annual interest rate (expressed as a decimal)

T = Time period (in years)

Let’s look at an example

Suppose you invest ₹1000 at an annual interest rate of 5% for 3 years.

So here, the principal amount (P) is ₹1,000, the annual interest rate (R) is 5% or 0.05, and the time period (T) is 3 years.

Using these values, you can calculate the interest rate,

SI = 1000 x 0.05 x 3

So, the simple interest (SI) earned over 3 years is ₹150.

To find the total amount (A) after the interest is added, use the formula:

A = P + SI

A = 1000 + 150

Therefore, the total amount after 3 years will be ₹1,150.

Compound Interest:

The compound interest calculation includes the principal amount, the interest rate, the number of times the interest is compounded per year, and the total number of years the money is invested or borrowed.

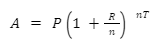

The compound interest rate formula is:

Where:

A = The future value of the investment/loan, including interest

P = Principal amount (initial amount of money)

R = Annual interest rate (in decimal form)

n = Number of times interest is compounded per year

T = Time period (in years)

Let’s look at a compound interest rate example to understand this better.

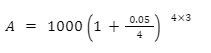

Suppose you invest ₹1000 (P) at an annual interest rate of 5%, compounded quarterly (n=4), for 3 years (T).

Using these values in the formula, you will get

Solving this equation, you will get

A = 1161.62

So, the future value of the investment/loan after 3 years will be ₹1,161.62.

Factors Affecting Interest Rates

Interest rates are not set in stone. While they impact investment returns and loan repayment costs, they are influenced by various factors such as the economy’s health, inflation, supply and demand, government policies, credit risk, and the loan period.

Economic Health

A growing economy with low unemployment increases the demand for goods and services. Businesses borrow more to meet this demand, pushing interest rates up. On the other hand, a weak economy leads to lower rates as lenders become less confident due to higher default risks and lower borrowing needs.

Inflation

Rising inflation compels lenders to raise interest rates. They need a higher return to ensure their investment does not lose value due to rising prices.

Government Policy

Government policies play an important role in setting interest rates. For example, the RBI adjusts short-term interest rates to control inflation and stimulate economic activity. These adjustments often have a domino effect, impacting loan and credit card rates as well.

Supply and Demand

Just like any market, interest rates are dictated by supply and demand. Lenders can charge more when there’s a high demand for loans as they have more opportunities to lend profitably. Conversely, with low borrowing demand, lenders lower rates to attract borrowers.

Credit Risk

Lenders charge higher interest rates to borrowers who are seen as risky to compensate for the chance they might not repay the loan. On the other hand, borrowers with good credit usually get lower interest rates because they are considered less risky.

Loan Period

The interest rate is significantly influenced by the loan tenure. With longer loan periods, interest rates may increase to cover the additional risks lenders may face over time.

Conclusion

Interest rates act as a bridge between borrowers and lenders. They represent the cost of borrowing for the borrower, like a fee for using someone else’s money. For instance, this cost is reflected in the interest rate on a personal loan, which you’d pay on top of repaying the principal amount. Conversely, lenders earn a return on the money they’ve lent through interest. Banks and financial institutions use the money they earn from loans to pay interest on savings accounts and certificates of deposit.

So, whether you’re borrowing to consolidate debt with a personal loan or saving for a future purchase, understanding interest rates helps make informed financial decisions.

Frequently Asked Questions

How is the interest rate determined?

Interest rates are determined by factors such as the central bank’s policies, inflation rates, economic conditions, and the borrower’s creditworthiness.

What role do central banks play in setting interest rates?

Central banks, like the RBI, set benchmark interest rates to influence economic activity, control inflation, and stabilize the currency.

What is the difference between nominal and real interest rates?

Nominal interest rates are the stated rates without adjusting for inflation, while real interest rates account for inflation and reflect the true cost of borrowing or return on investment.

How are personal loan interest rates calculated?

Personal loan interest rates are typically calculated based on the borrower’s credit score, their income and the loan amount term.

What is an APR, and how is it different from an interest rate?

APR (Annual Percentage Rate) includes the interest rate and other costs or fees involved in securing the loan, providing a more comprehensive view of the borrowing cost.