If you run a business, you already know this truth: money needs don’t always come with a warning.

Some days, you’re doing great, sales are flowing, customers are paying on time, and everything feels smooth. But other days? You may need funds to pay salaries, restock inventory, or handle urgent expenses. And then there are bigger goals too, like expanding your business, buying equipment, or opening a new branch.

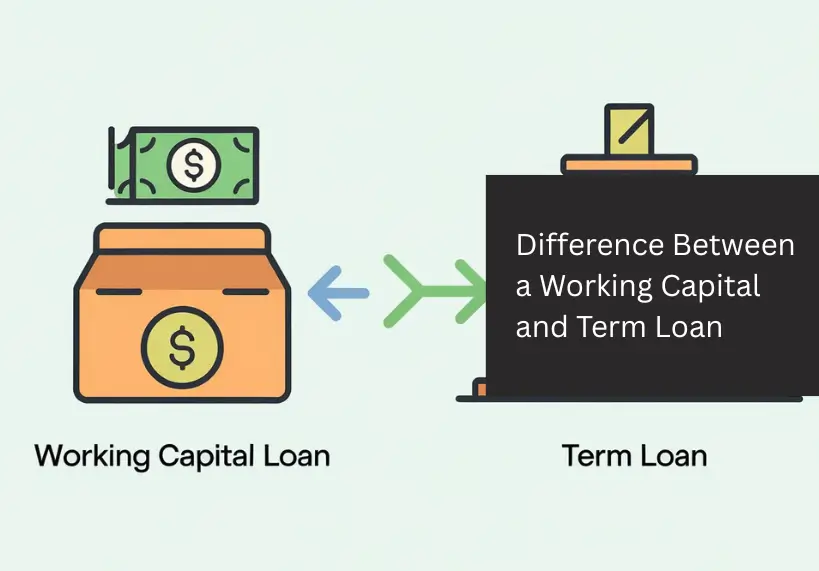

That’s exactly why loans exist. But here’s the confusing part: which one should you choose, working capital loan or term loan?

Don’t worry. In this blog, we’ll break it down in the simplest way possible.

Working Capital Loan Meaning

A working capital loan is basically a short-term loan that helps you manage your day-to-day business expenses.

Think of it like a “cash flow support system” for your business, especially when payments are delayed or expenses suddenly rise.

You can use it for things like:

- Paying salaries and rent

- Buying inventory or raw materials

- Paying vendors on time

- Handling seasonal sales slowdowns

- Covering short-term cash gaps

In short, it helps your business run smoothly even when cash inflow isn’t consistent.

Term Loan Meaning

A term loan is a loan you take for a fixed time period and repay in regular installments (usually monthly EMIs).

This type of loan is generally used when you have a bigger business goal in mind, something that will give returns over time.

You can use it for things like:

- Buying machinery or equipment

- Expanding your shop, office, or warehouse

- Renovation or upgrades

- Opening a new branch

- Funding long-term growth plans

So instead of solving today’s cash problem, it’s more about building tomorrow’s business success.

Key Differences between Working Capital Loan vs Term Loan

Here’s a simple table that makes the comparison super clear:

| Feature | Working Capital Loan | Term Loan |

| Purpose | Helps manage daily operations | Supports long-term business growth |

| Best for | Salaries, rent, inventory, urgent expenses | Expansion, equipment, assets, upgrades |

| Loan Tenure | Short-term (months to a few years) | Medium to long-term (1–5+ years) |

| Repayment | Flexible or frequent repayments | Fixed EMIs for a fixed period |

| Approval Speed | Usually faster | May take more time |

| Collateral | May or may not be required | Often required for larger amounts |

| Loan Amount | Smaller compared to term loans | Higher amounts possible |

| Cash Flow Impact | Helps stabilize cash flow | Adds a long-term repayment commitment |

| Risk Level | Lower long-term burden | Bigger commitment, but structured |

| Ideal for | Businesses needing quick support | Businesses planning steady growth |

This is the easiest way to understand the difference when comparing term loan vs working capital loan.

Working Capital vs Term Loan: Which Is Better?

Now comes the real question: Which one should you pick?

Here’s the simplest way to decide:

Choose a Working Capital Loan if:

You need money to keep your business running smoothly right now.

For example:

- your customers pay late

- you have urgent inventory needs

- you need to manage monthly expenses

- sales are seasonal or unpredictable

Basically, it’s for short-term support and stability.

Choose a Term Loan if:

You’re planning something bigger and long-term.

For example:

- buying new machines

- opening a second branch

- renovating or upgrading

- expanding your production or team

A term loan works best when your business has a growth plan and you’re ready for fixed EMIs.

Many businesses also explore options through platforms like loantap, depending on eligibility, repayment comfort, and funding needs.

So honestly, the “best loan” depends on your business situation, not just the interest rate.

Conclusion

At the end of the day, both loans are useful, but for different reasons.

A working capital loan helps you manage short-term expenses and cash flow gaps, while a term loan supports long-term business growth.

The smart move is choosing the one that matches your business goal and repayment capacity. Whether you’re trying to stabilize operations or expand confidently, the right business loan can help you move forward without stress.

Disclaimer: Loan terms, eligibility, interest rates, and requirements vary by lender and borrower profile. This content is for informational purposes only.

FAQs

1. What is the main difference between a working capital loan and a term loan?

A working capital loan is for short-term business expenses, while a term loan is for long-term investments like expansion or asset purchase.

2. Can a business take both loans together?

Yes, many businesses use working capital loans for daily operations and term loans for expansion, if they can manage repayments comfortably.

3. Which loan has faster approval?

Working capital loans are often approved faster because they’re short-term and easier to process, but it depends on your eligibility.

4. Is a term loan only for big businesses?

Not at all. Even small and medium businesses can take term loans if they meet the lender’s requirements.

5. Which loan is better for cash flow management?

Working capital loans are better for managing cash flow because they help cover regular operational expenses.