Personal loans are expensive, but they sure can help you in a situation when you need a lot of money in a short period. Besides, they are easily accessible, especially in the case of online loans. However, a lot of times people get a personal loan when they don’t really need one. Plus, it doesn’t help that it is hard to decide which reasons are valid for getting a loan in the first place.To help you out, here are 5 good reasons to get a personal loan:

1) Paying off Debt

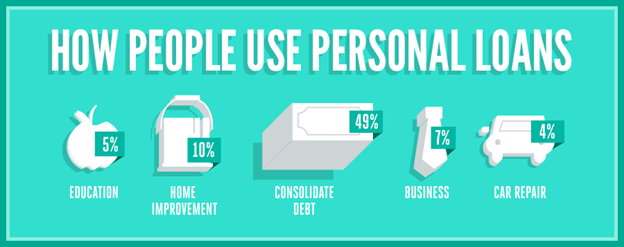

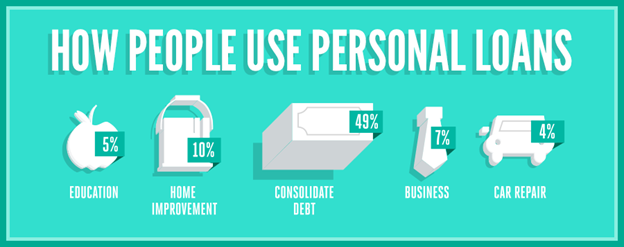

A sensible and wise use of a personal loan is paying off other loans that are becoming hard to manage. If you have a large outstanding amount from another loan, or a credit card then you can use a personal loan for clearing the debt.

A personal loan generally has a lower interest rate than other kinds of loans such as a home loan, or a student loan. Thus, even though you would still have to pay interest on your personal loan after you have paid off another, it would be more affordable. Also, your CIBIL score can be saved in the process as well, as huge pending bills and debt can be highly detrimental.

Learn More About: Factors Affecting CIBIL Score

2) Medical Emergencies

You can’t put a price on someone’s life, which is why we never care for money when our loved ones are not in good health. Unfortunately, good quality health care is not easily affordable these days, and when a medical emergency strikes people often struggle with the expenses. In such situations, a personal loan can be really helpful. Not only can you apply for an online personal loan anytime you want, you can receive the funds in a short period (within 24 hours in case of LoanTap’s instant personal loan).

3) Moving Costs

Moving to a new place, especially in a new city can be quite an expensive affair. Not only you have to arrange for an upfront security deposit, there are many other kinds of expenses to deal with viz. new furniture, lighting fixtures, renovation, electronic appliances, etc. If you are unable to afford all this, then getting a personal loan can be a good idea. Even if you have sufficient credit left on your credit card, a personal loan could be a better option, for its interest rates are usually lower. Besides, your credit card balance can be used later for unexpected expenses, if there are any.

4) Car Repair Bills

If you have ever got your car repaired, then you know how expensive the bills can get. Even minor car paint repairs could set you back by a few thousand rupees, and if there is a need for component replacement then the bills can go a lot higher. However, when your only means of transportation is out of order, then you have no choice but to pay for the repairs. You can always take a personal loan in such situation if needed, but try to repay it as soon as possible to minimize the interest.

5) Home Renovation

Home renovation is also sometimes a good reason to get a personal loan, for quality paints, lighting fixtures, bathroom fixtures, etc. combined with all kinds of repairs can be quite costly.

Just like there are many good reasons for getting a personal loan, there are a fair share of bad ones too. Here are the top 5 of them:

1) Gambling

Gambling lies in a somewhat grey area when it comes to ethics. If it is legal in your area, then engaging in it is perhaps not wrong. However, if your compulsions are so strong that you have to take personal loans just to partake in gambling, then it can never be a good idea.

2) Investing in Stock Market

Investing in stock market is always risky, but still there are people who remain undeterred and make a fortune from their investments. If you are feeling lucky then there is no harm in giving it a shot. However, if you have to take a personal loan for that then it can easily end badly. Companies go bankrupt all the time, and if your money is on one then you could end up paying EMIs for a loan that dissolved completely.

3) Investing in a New Business

Starting your own business can often be a life changing experience. However, you should avoid taking a personal loan for the investment. This is because there are plenty of better options such as roping in co-investors or angel investors, or choosing asset-based loans, small business loans, etc.

4) Illegal Activities

Banks are really prudent when they consider applications for a personal loan. Reasons play a big role in influencing their decision regarding the approval or rejection of an application. However, as long as your reasons are valid and reasonable, you are good. On the other hand, if there is even a slight hint of immoral motives, then you can consider your application rejected.

Learn More About : Rejection Reason of Personal Loan Application

If you use a personal loan for illegal activities, then when your lender finds out, they can slap a heavy penalty, or even take a legal action against you. This is why your reasons for taking a personal loan should always be within the bounds of legality.

5) Giving a Loan to a Friend

People often take personal loans on behalf of their friends, when they claim they are not eligible themselves. However, in no circumstances is this a good idea.

A loan comes with a big responsibility, and if you default, or miss payments, it can have repercussions on your credit score. There is no reason to take such a big risk for someone else.

Whenever you have to decide if you should get a loan or not always ask yourself two things- 1) Is the loan absolutely necessary? 2) Is the loan for an appreciating asset(house, for instance). If the answer to any of these two questions is yes then the loan can be a good idea.

Download our Instant Loan App: Google Playstore / Apple App Store