With one generation paving way for the next, a new aspirational framework has started to evolve. More and more people are beginning to nurture dreams that are not constrained by the limitations of income, needs and ambitions. In fact, the mindset which relies on cutting expenses and waiting for the monthly disbursal of salary does not seem to be relevant anymore. Instead, a new wave of millennials has emerged whose primary purpose in life is to make the most of what they have today!

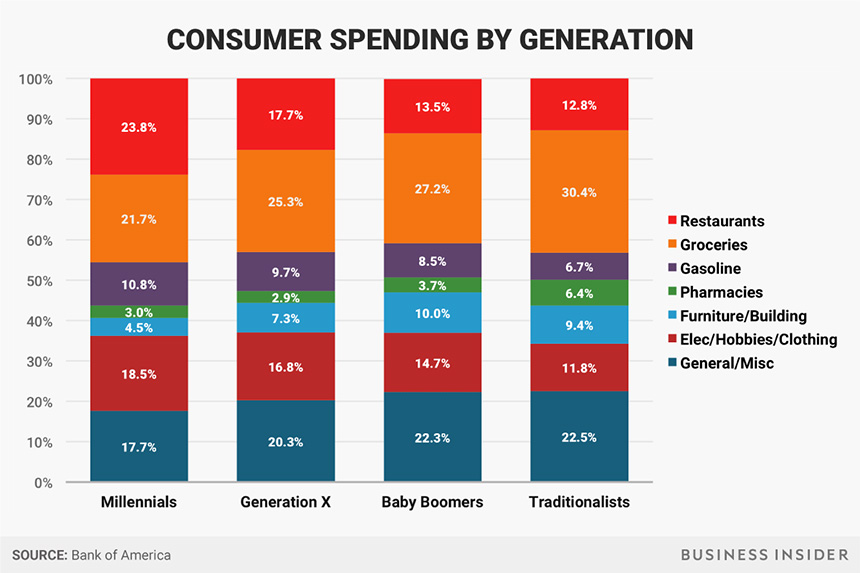

These changing lifestyle needs of the 7.4 billion global millennials have been highlighted in the chart below:

(Chart Courtesy : Business Insider)

As per this data, while the older, traditional generations preferred saving up for miscellaneous or unforeseen expenditures, the millennials have taken an entirely different route. They are opting to spend money for fulfilling more instant requirements like restaurants, clothing, traveling and hobbies.

These changing lifestyle needs have also led to a complete transformation in the financial habits of millennials. They are now looking for easy-to-use, collateral-free and pocket-friendly new age loans. It is precisely to cater to such reoriented demands that lenders – especially digital lending platforms – have started coming up with different varieties of low EMI, modest interest rate and quick loans. These special loans have the potential of providing millennials with the unique opportunity to give wings to their dreams without facing any hassle, struggle or stress.

Listed here are all loan products which have been specifically designed to fuel the aspirations of modern, Indian millennials –

- Holiday Loan

Have you been planning to take a vacation but have been unable to do so because of the unavailability of finances? Don’t worry. A holiday loan will take care of all your travel expenses! Holiday loans are basically low interest rate loans which are sanctioned to facilitate your journey within or outside the country. They take care of your air fares, accommodation charges and other similar expenditures which are likely to be incurred during your trip.A Holiday Loan from LoanTap, for instance, is accessible through a transparent online process within a short time period of 24 to 36 hours! More so, it allows you to make an interest-only payment for the first 3 months, so that you can have adequate time to recuperate from the high-expense holiday. These low EMI loans, therefore, can prove to be the perfect fit for your vacation! - Wedding Loan

Getting married is a once in a lifetime affair! So, why not make it count? Be it the royal palaces of Rajasthan or the tranquil shores of Goa, with a wedding loan in your kitty, you can turn your marriage into a memorable experience. A wedding loan can help you bear all marriage expenses ranging from venue and catering to decoration and outfits. It can also permit you to take financial matters into your own hands, instead of having your family /parents break into their savings.At LoanTap, quick Wedding Loans for a marriage are provided at low EMIs and lower interest rates. For the first five months, you only have to pay the applicable interest amount. This makes sure that you have sufficient time to ease your expenditure post-marriage. The EMI payment towards the principal outstanding begins only from the 6th month onwards, thus, making your entire loan process, extremely simple and stress free. - Rental Deposit Loan

Moving in to a rental apartment can often prove to be a highly restraining task. To begin with, you have to find an area that isn’t too far from your place of work. Then, you need to finalize an apartment that meets your specific requirements. This is to be followed by submitting an advance security deposit to your landlord, which is usually equivalent to a rental amount of 8-12 months!A Rental Deposit Loan from LoanTap can easily help you escape this situation. It allows you to directly deposit the security amount into the landlord’s account, without worrying about paying hefty EMIs. You are only liable to pay the interest amount, throughout the duration of the lease. On termination of lease or end of loan tenure, the principal is repaid. With a Rental Deposit Loan at your disposal, renting a home becomes completely secure and uncomplicated. - Advance Salary Loan

A financial need does not always wait for your salary. It emerges out of the blue and casts a major dent on your savings. Whether it is an annual TV recharge or a medical emergency – if you’re dealing with something that can’t wait till the end of the month, advance salary loans are your best bet! These loans provide youThe Advance Salary Loan from LoanTap, for instance, permits you to borrow an amount up to 2.5 times your net monthly salary. An Advance Salary Loan works wonders, especially when it comes to meeting instant demands. For millennials, it is the premium way to tick items off their bucket list! - Premium Bike Loan

Have you been holding off on that road trip because you didn’t have enough money? If that has been the case, don’t fret! A premium bike loan will make sure that you get to own a bike of your choice within 24 to 36 hours. Premium Bike Loans with their attractive interest rates and flexible repayment options can help millennials kick start their adventures, without having to wait any longer.These loans are available at LoanTap, with a 40% lesser monthly cash outflow and a 100% funding on the total road price. All you have to do is pay the interest amount due for the first 6 months, whereas the principal can be paid after every 6 months. The Premium Bike Loan accommodates all your financial obligations by allowing you to repay in regular, low EMIs. So, if you have been delaying your highly cherished road trip, the time to undertake it is now!As a millennial, your dreams might not be always funded by your earnings. This is why all loan products at LoanTap, have been specially crafted to give you the ease of availing instant cash. You not only get to pay lower instalments, but you also get to enjoy modest interest rates.With these demand-based loans sponsoring your goals, you wouldn’t have to worry about costs or savings anymore. The entire world would be yours to conquer!