Imagine a situation where you are in an urgent need of money. What would be your natural response? You’d look for the easiest way out, well maybe a payday loan or you’d have your all-time friend, credit card. Not wise, you are unaware of the new schemes that are far better and are easily processed. Going for credit cards and payday loans is like sticking to the same restaurant and eating the same food again and again, while you could have just walked down the corner to another block and explored a new set of restaurants, which serve better food with great ambiance. In this case, these new restaurants are Personal/Salary Overdrafts.

In simple terms, personal overdraft is an account that provides you with a credit while the interest is not calculated until you start using the money. Therefore, you have the money, and you do not pay unless you use it. Personal Overdrafts easily hold an edge over payday loans or credit cards

Apply for a Personal Overdraft Loan

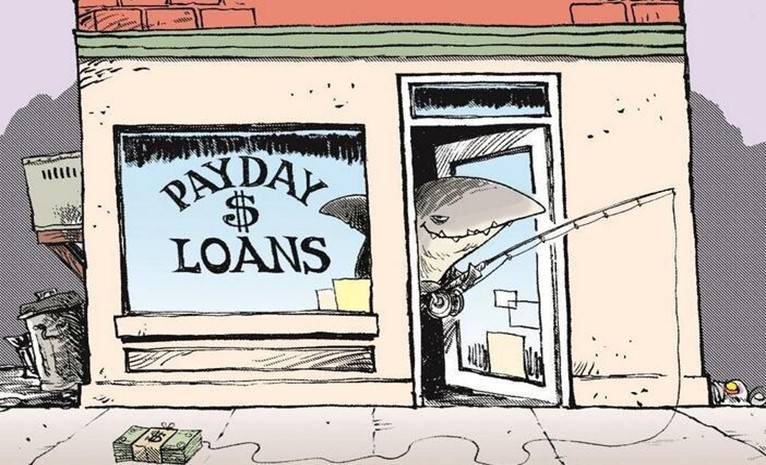

What are Payday loans?

The basic idea of a payday loan is in its name itself. It is a small amount of money lent to a borrower at a quite high-interest rate on an agreement that it will be returned to the lender when the borrower receives his/her next salary. payday loan period is quite short and the amount is based on the salary of the employee. It is not necessary that the repayment of the loan will be linked to the borrower’s payday. Since it is easy to obtain, people do not look out for other easier options.

Some features of payday loan are as mentioned:

-

High-interest rate

The interest rate can go up to 50 %. Consider a situation when you have taken a loan of Rs 10,000 and you pay Rs 15000 at the end of it. That is what happens in the case of payday loans. The rules associated with it are severe and you will have to return the amount in the given period.

-

Short-term

Payday loans are short-term, which means the usual period is 30 to 60 days. With high-interest rate and stringent laws, a payday loan is a huge no. One cannot afford to incur late fees and adding to that they are less flexible with respect to days of return and Loan Tenure

-

Principal amount constraint

In payday loans, the amount that can be borrowed is considerably low as compared to overdrafts. An amount of Rs 30,000 to Rs 40,000 is what you have at your disposal with a high-interest rate and a very short period to return it.

-

Processing fee

Payday loans not only come up with high interest rate but also a processing fee. It is a certain percentage (say 20%) of the principal amount, which you have to pay back to the financial institution, which has offered you the loan. So not only you are paying interest, you are also paying for its processing.

-

Applying for Payday loan can be cumbersome

Though these loans can be easily procured, the complication lies in the terms and conditions while applying for it. One needs to skim through those documents, no option to that..!

Calculation of Payday loans:

The payments are done in fortnights or on weekly basis. It can be either a direct deduction from your salary or your account. Consider a scenario when you have borrowed Rs.10, 000 at an interest rate of 4% per month for three months. Then that calculates your interest amount to Rs 400/month. So, by the end, you will be paying Rs.1200 as the interest amount. However, don’t forget the processing fees.

Are Credit cards good option?

A Credit card is like that friend of yours who does not have any emotional bondage with you and just stays around for luxury flowing out of your pockets. Obviously, you do not understand that until they cheat on you with the unsentimental interest rates and penalties. And surely, you do not want that kind burden and torment in your life.

Things to be considered while using credit cards:

-

Unjustifiable rate of interest

With interest rates reaching heights, you do not want to go down that path. You can get charged as high as 40% annually.

-

Revolving Credit

With credit cards having an option of minimum monthly payment, most users stick to paying only the minimum amount to avoid penalties. It is a delusion that the rate of interest might not increase if done so, and the interest keeps on adding up.

-

Risk of ruining you CIBIL score

Falling into a credit card trap is bound to ruin you CIBIL score, which will then affect the ease of getting loans sanctioned in the near future.

-

Many overheads

A person should be careful enough not to fall prey to the credit card frauds. The policies can be a huge drag if ignored because they can land you in debts. In addition, a lot of energy and time goes in handling the expenses across multiple cards when a person has many of them

When you have debts in multiple credit cards, the most sensible thing to do is to replace all of them with a single EMI Free Loan or Credit Card Takeover. However, some set of cardholders opt for a credit Card Rollover, which is using another credit card to pay the dues of previous ones if this new card comes with lower IR. Despite that, the IR for credit cards will always be higher. Therefore, credit card rollover is never a sensible choice. Instead of sticking to credit cards or payday loans, one can also go for short-term loans. However, the thing with the traditional loans is the lack of flexibility when it comes to repaying the amount. Some companies even charge pre-pay penalties.

Salary overdraft is one single solution for all your problems and is the best option when you need urgent money. Even if you do not need money, there is no harm in opening an overdraft account, as the interest is not charged until you withdraw from it.

What exactly is a Personal Overdraft?

Consider a scenario where you are going to throw a birthday party and you have Rs 10,000 with you. You have lent another Rs 2,000 from a friend as a precaution. If you did not use the money, you will pay back your friend those Rs 2,000 without any interest. Personal Overdraft is that friend of yours who promises to provide you the additional Rs 2,000 if you require it. It is an account that you open to help you keep a certain amount of money separately from the total funds already present. You can withdraw the money whenever you need to. Simply, it can be a scheme applied to your daily account using which you can access additional funds than the amount available in your account. You can exceed the limit of funds in your account and the amount exceeded accounts to money borrowed from the financial institutions. This additional money remains in your account and you are not charged interest for it until you use it.

Features of Personal overdrafts are:

-

Lower rate of interest

Payday loan and credit cards go heavy on your pockets because of their high-interest rates. This is not the case with salary overdraft. Consider a situation in which you have a payday loan that you received at the starting of the month and you use it at the end of it. In such case, you would be paying interest for all this time when money was just kept with you despite the fact you were not using it. Overdraft solves this issue, as you do not have to pay interest amount until you withdraw that money. The rate of interest for overdrafts is usually 12-20%.

-

Easy Disbursal

In the case of overdrafts, the money is available in your account for use within 24 working hours. If you go for a traditional loan, there is lots of paperwork involved and you have to go to different financial institutions for getting it sanctioned. In addition, you have maintained your CIBIL score as per the industries’ norms in order to get the loan sanctioned. When it comes to overdraft, the process is very pleasant.

-

Sky is the limit

Payday loans are short-term loans in which you can get a stipulated amount, which you have to repay in a short period. However, in personal overdrafts, you can have it for years and you can have a comparatively higher limit when it comes to withdrawing additional funds. There are different criterions for withdrawal of money as some financial institutions might allow you to withdraw up to thrice your salary; others might allow you to withdraw twice the money in your account, etc.

-

No EMI

The most salient feature of an overdraft is that it is like a No EMI loan which lends you money and you just have to pay interest for the additional amount of money that you’ve withdrawn from your account. You can pay the entire amount in one go whenever you have the money to do so.

-

Protection of CIBIL score

Since, in overdraft, you do not use the additional money until you have to; it helps in keeping you CIBIL score healthy, as you are not already indebted to anyone.

-

Flexibility

In payday loans, you have to pay the monthly or fortnightly EMIs with utmost discipline. If failed to do so, you suffer from late payment penalties. However, Overdraft provides you flexibility since you just have to pay the interest calculated on the additionally used amount. You can pay the principal amount whenever you have it with you. You can also pay them in fractions if you want. Therefore, the payment is not restricted and as you go on paying your principal amount, the interest rate is calculated on the remaining principal amount.

So, repayment becomes more affordable and easy.

-

Less Paperwork

Unlike traditional loans, not much paperwork is required in case of Overdrafts. You can do the initial process online and get an estimate of your loan eligibility online.

How to apply for a Personal overdraft?

All you have to do is fill in your basic information like your income, EMI outflow, rent outflow, years of employment, online and upload or mail basic docs as per your convenience. And If you are opting for LoanTap Personal Overdraft, the process becomes simpler. After submitting the necessary documents online, a representative will visit your home to collect another set of documents, and the money will be disbursed in your account within 24 hours post verification.

Overdrafts or Flexi Loan are the best solution in times of emergencies whether it be medical, personal, or social. It is some extra funds available to you if you want to use them. With a small turnaround time of 24 hours, such flexibility, no employment criteria, and fast disbursal of the amount into your account, one should not think twice about going for an overdraft. It gives you easy and full control on your daily expenses and it is like a helping hand when the harsh time hits you. It is like some saved money that is already kept in your account, which you do not want to use unless you really have to, forced by circumstances.